Cracks in AI productivity bull case

Productivity questions loom over AI investments

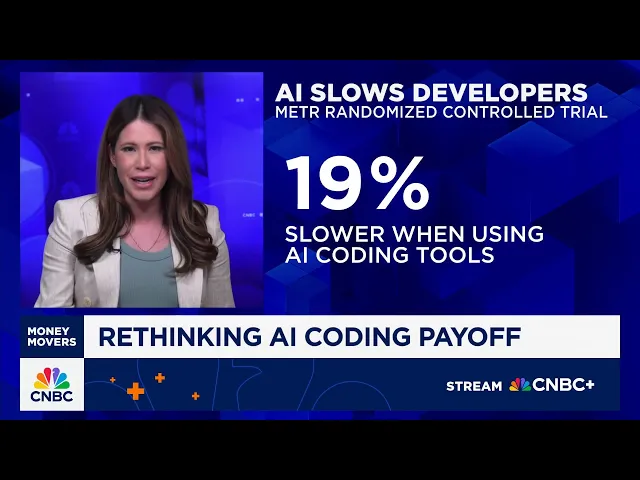

The business world is abuzz with promises of AI revolutionizing productivity across industries. Yet beneath this excitement lies a critical question that deserves more scrutiny: are current AI investments actually delivering measurable productivity gains? This disconnect between AI hype and tangible results forms the center of a growing debate about the technology's true economic impact.

Key Points:

- Despite massive investments in AI (particularly generative AI), productivity data remains underwhelming, creating a paradox between anecdotal successes and macroeconomic metrics

- Many businesses are experiencing an "AI tax" – where implementation costs, learning curves, and workflow disruptions temporarily reduce efficiency before realizing potential gains

- Historical technology adoption patterns suggest we're in an awkward transition period where companies are still figuring out how to effectively integrate AI into business processes

The AI Productivity Paradox

The most compelling insight from this analysis is what we might call the "AI implementation paradox." While executives and tech leaders trumpet AI's transformative potential, the macroeconomic data remains stubbornly unimpressed. This paradox isn't unprecedented – economic historian Paul David famously observed that electrification took decades to significantly impact productivity statistics, despite its revolutionary potential. We may be witnessing a similar phenomenon with AI.

What makes this particularly relevant is how it challenges the current wave of AI investment justifications. Companies worldwide are pouring billions into AI capabilities based largely on theoretical productivity gains, creating potential vulnerabilities if these investments don't materialize into bottom-line improvements within expected timeframes. For public companies especially, this creates tension between the long-term strategic imperative to adopt AI and the short-term pressure to demonstrate ROI.

Beyond the Hype: What's Really Happening

The current AI landscape reveals a more nuanced picture than either the techno-optimist or skeptic camps acknowledge. Consider the healthcare sector, where AI diagnostic tools have shown impressive accuracy in controlled studies but have struggled to integrate smoothly into clinical workflows. A 2023 Mayo Clinic implementation of an AI diagnostic assistant initially slowed physician consultations by an average of 7 minutes as doctors learned to incorporate the tool – creating exactly the kind of "AI tax" discussed in the video.

This implementation friction extends beyond healthcare. Financial services firms report spending 3-4 times their initial

Recent Videos

How To Earn MONEY With Images (No Bullsh*t)

Smart earnings from your image collection In today's digital economy, passive income streams have become increasingly accessible to creators with various skill sets. A recent YouTube video cuts through the hype to explore legitimate ways photographers, designers, and even casual smartphone users can monetize their image collections. The strategies outlined don't rely on unrealistic promises or complicated schemes—instead, they focus on established marketplaces with proven revenue potential for image creators. Key Points Stock photography platforms like Shutterstock, Adobe Stock, and Getty Images remain viable income sources when you understand their specific requirements and optimize your submissions accordingly. Specialized marketplaces focusing...

Oct 3, 2025New SHAPE SHIFTING AI Robot Is Freaking People Out

Liquid robots will change everything In the quiet labs of Carnegie Mellon University, scientists have created something that feels plucked from science fiction—a magnetic slime robot that can transform between liquid and solid states, slipping through tight spaces before reassembling on the other side. This technology, showcased in a recent YouTube video, represents a significant leap beyond traditional robotics into a realm where machines mimic not just animal movements, but their fundamental physical properties. While the internet might be buzzing with dystopian concerns about "shape-shifting terminators," the reality offers far more promising applications that could revolutionize medicine, rescue operations, and...

Oct 3, 2025How To Do Homeless AI Tiktok Trend (Tiktok Homeless AI Tutorial)

AI homeless trend raises ethical concerns In an era where social media trends evolve faster than we can comprehend them, TikTok's "homeless AI" trend has sparked both creative engagement and serious ethical questions. The trend, which involves using AI to transform ordinary photos into images depicting homelessness, has rapidly gained traction across the platform, with creators eagerly jumping on board to showcase their digital transformations. While the technical process is relatively straightforward, the implications of digitally "becoming homeless" for entertainment deserve careful consideration. The video tutorial provides a step-by-step guide on creating these AI-generated images, explaining how users can transform...